Can home charging station be semi-public?

The strong growth of electric vehicles (EVs) in Belgium is leading to more and more families having their partner also drive electric.

Usually, the partner’s employer recommends installing a second charging station.

But in many cases this is an inconvenient cost since you only charge every 3 to 4 days per car.

And also because there is not always room to install a second charging station.

What is widely recommended is to open up the existing charging station via roaming to the partner.

But then without sharing the location via apps since the charging station is on private property.

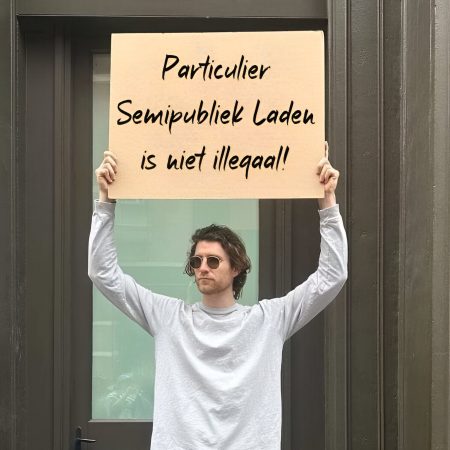

Some market participants prohibit this practical solution and raise legal arguments, as there would be sale of electricity by a party that is not an energy supplier.

STROOHM is looking out for you!

Legal Framework

The fact that a supply license would be mandatory for the redelivery of electricity to the partner is unfounded.

We are referring here to public charging points where identical transactions take place but where also the operator of the charging station is not required to have a supply license.

Only energy suppliers that are active in the energy market and sell energy directly to consumers (B2B or B2C) need to apply for a supply license.

For a service behind the energy meter, no supply license is required.

A trustee who redistributes the energy bill among the various users is also not an energy supplier.

More information can be found at VREG for regional or CREG for federal for who must have a supply license. Role of the Charge Point Operator (CPO) The CPO manages and maintains the charge points and sets conditions of use, such as tariffs and access rules.

The CPO can set the charge point semi-public and may or may not activate site publication. Sales, Registration and Taxation Private individuals may sell electricity through their charging stations as long as they do not conduct it for profit.

Sales for profit lead to tax liabilities.

Income from the sale of electricity must be declared and the operator of the charging station must then have a VAT number.

With STROOHM ‘s innovative solution, the owner of the electricity is no longer a private person but the employer, and this is perfectly tax-efficient.

Thus, making charging stations semi-public is allowed provided the tax rules are met which is fully in order with STROOHM ‘s innovative solution .

Bart Massin

Conclusion

Therefore, making charging stations semi-public is allowed provided the tax rules are met which is fully in order with STROOHM ‘s innovative solution .

It is important to be well informed and not just believe what is claimed on facebook platforms.

You can reach Stroohm at info@stroohm.be for all your questions regarding the installation, regulation, and management of your charging infrastructure.

Send us an email, and we will be happy to help you realize your project.